Lummis, Senators Grill SEC Chair Over Financial Regulations

Top financial regulator defends ramping up oversight of climate, crypto and AI

- Published In: Politics

- Last Updated: Sep 14, 2023

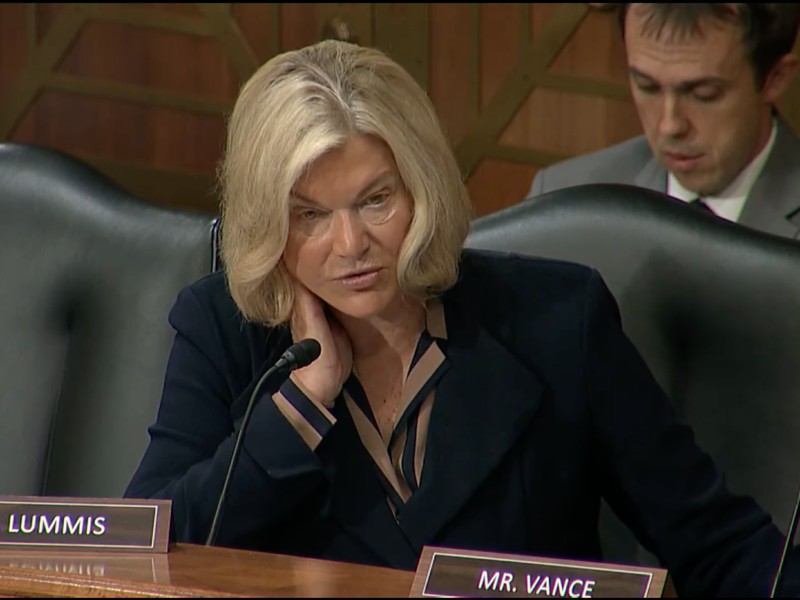

Sen. Cynthia Lummis (R-Wyo.) pressed Securities and Exchange Commission Chairman Gary Gensler about new regulations impacting the crypto and AI industries. (Photo via YouTube / Senate Banking, Housing and Urban Affairs Committee)

By Jacob Gardenswartz

Special to the Wyoming Truth

This story was updated with Ohio Sen. Sherrod Brown’s correct party affiliation on September 14, 2023 as of 1:30 p.m. MT

WASHINGTON — Securities and Exchange Commission (SEC) Chairman Gary Gensler was in the hot seat on Tuesday, testifying before a U.S. Senate panel as his agency is proposing new regulations impacting emerging technological industries like crypto and AI.

Gensler, a former financial regulator in the Obama administration and the top official in Hillary Clinton’s 2016 presidential campaign, came under immediate attack from Republicans on the Senate Banking, Housing and Urban Affairs Committee for what they described as unnecessary regulations stifling economic development.

“Your agency has churned out a seemingly endless assembly line of new and unneeded regulatory hurdles to capital formation and market access,” said Sen. Tim Scott (R-S.C.), the ranking Republican on the committee and a 2024 presidential candidate.

Democrats mostly praised Gensler’s work, calling on the SEC to protect against financial mismanagement — particularly in the digital asset space.

“America’s markets are the greatest in the world because we have strong investor protections and because we have effective regulators at the SEC,” Chairman Sherrod Brown (D-Ohio) said. “We only need to look to events in the crypto markets in the past year to see what happens when markets lack transparency and conflicts go unchecked: Americans lose money.”

Gensler defended his agency and the rulemaking it has conducted. “Even a gold medalist must keep training, and that’s why we’re updating our rules for the technology and business models of the 2020s,” he testified.

And he appeared to share Democrats’ concerns about the cryptocurrency space, showing no intention to back down on aggressive regulatory enforcement.

“I’ve been around finance for 44 years now, I guess, and I’ve never seen a field that’s so rife with misconduct,” Gensler said. “It’s just— it’s daunting.”

Questions about crypto, AI technologies

The focus on cryptocurrencies and AI in the hearing came as lawmakers were set to meet behind closed doors this week with the heads of top AI companies, and as legislative proposals to regulate both AI and cryptocurrencies are making their way through Congress.

Some Democrats who’ve long been skeptical of the growth of the digital asset space claimed vindication in the wake of the collapse of cryptocurrency exchange FTX last year and subsequent prosecution of its founder for fraud, calling on Gensler to continue aggressive regulatory scrutiny of the industry.

“FTX wasn’t a lone, bad apple — it was just the most explosive example of the problems in crypto,” Brown said. “It seems like every day, before and after FTX’s collapse, there’s another crypto scam hacker insider taking advantage of people, and another few million dollars lost.”

But Republicans were more critical of SEC oversight of the industry, pointing to a recent appellate court decision that found the agency was wrong to deny the cryptocurrency company Grayscale Bitcoin Trust’s application to create a spot bitcoin exchange-traded fund (ETF), a security product which enables investment in cryptocurrencies without buying them directly.

Though the SEC under Gensler has denied requests to enter the market from Grayscale and other bitcoin providers, a three-judge panel of the District of Columbia Court of Appeals ruled the agency failed to fully explain why it had done so and must review its decision. The court didn’t require the SEC to grant Grayscale’s request, but the ruling served as a victory for the cryptocurrency industry — with top exchanges rallying significantly on the news.

Pressed about how the agency would respond to the ruling, Gensler demurred. “We’re still reviewing that decision,” he said, noting there are multiple similar requests from other companies. “I’m looking forward to staff’s recommendations.”

Sen. Cynthia Lummis (R-Wyo.), dubbed the Senate’s “crypto queen” and a leading force behind a sweeping crypto regulations bill, pressed Gensler on matters she described as “substantially nerdier than my colleagues.”

On crypto, she honed in on the SEC’s Staff Accounting Bulletin 121, agency guidance issued in March of 2022 concerning how SEC-registered entities are obligated to protect crypto assets held for platform users and the risks associated with such arrangements.

Echoing other GOP critiques, Lummis took issue with provisions she claimed prevented banks from offering crypto asset custody. “If your ultimate goal is to provide real consumer protection, shouldn’t the SEC withdraw Staff Accounting Bulletin 121?” she posed.

But Gensler argued the guidance concerned only how publicly-traded companies should handle crypto assets for accounting purposes — not how banking regulators handle such topics. “We don’t speak to how it’s backed. That’s up to the bank regulators,” he testified.

Lummis also questioned a new SEC proposal aimed at preventing conflicts of interest when using AI tools in the financial industry. She claimed the rule as it’s written includes an “overly-broad description of covered technology, encompassing all uses of technology in a firm down to adding together numbers in a spreadsheet.”

But highlighting that the rule has yet to be finalized, Gensler again declined to discuss specifics, promising only to respond to input from stakeholders as the agency finalizes the proposal: “We commit to taking public comment seriously.”

No timeline for controversial climate rules

Another major area of focus was the SEC’s controversial climate disclosure rule that has drawn significant criticisms from industry leaders, Republicans and even some Democrats who are worried it would overly burden key industries.

The rule, proposed early last year, would require public companies to share information with investors about their businesses’ impact on the climate and take into account not only their direct carbon output, but also that of their supply chain and customers, so-called “Scope 3” reporting.

Though SEC regulators have purview only over large, public companies in the U.S., businesses of all sizes have expressed concerns about the strain of complying with such regulations, as larger companies would likely seek detailed information from smaller firms involved in their businesses.

Sen. Jon Tester (D-Mont.), who is up for reelection next year, highlighted the need to ensure the proposal “does not lead to burdensome record reporting requirements to add additional workload [and] pain in the neck,” particularly for small farms.

Gensler again stressed the rule would only impact public companies, insisting his agency is “not a climate regulator.” Noting upwards of 80% of public companies already provide some form of such disclosures, he promised to “make sure that we’re only regulating the public companies and not, somehow indirectly, those private companies.”

Pressed later on the timeline for when the final rule would be released, he again dodged. “We try not to do things against a clock. It’s really when the staff is ready.”

The back-and-forth highlighted a growing debate over the role financial regulators should play in combating climate change. Last month, a Jackson Hole meeting of the Federal Reserve Board of Governors faced viral protests calling for greater climate action, leading to the arrest of one organizer.