Wyoming Boasts Most Favorable Small Business Tax Rates in US

New report finds state’s lack of income taxes, low sales and unemployment taxes create friendly environment

- Published In: Other News & Features

- Last Updated: Jul 09, 2023

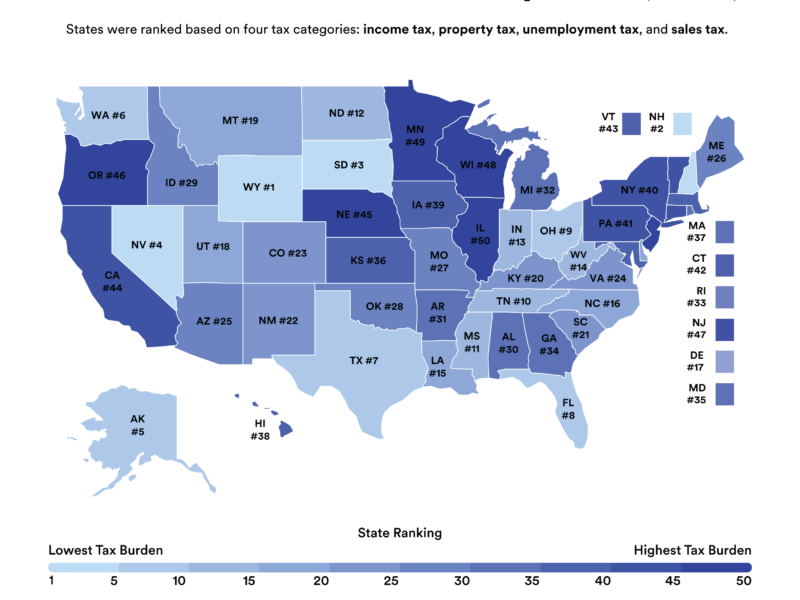

A map of the U.S. shows the states that impose the lowest and the highest tax rates on small businesses, based on corporate and individual income taxes, property taxes, sales taxes and unemployment taxes levied by state. (Courtesy map from Swyft Filings)

By K.L. McQuaid

Special to the Wyoming Truth

Wyoming is the friendliest state in the U.S. for small businesses in regard to taxes, thanks to its lack of corporate or personal income taxes and relatively low sales tax rates, according to a new survey of data nationwide.

In reaching that conclusion, business support firm Swyft Filings looked at both personal and business income tax rates, state and other sales tax rates, property taxes and unemployment tax rates and formulated a composite score.

“If you’re a [limited liability company] or an owner/operator, the lack of income tax and lowered tax rates plays a huge part in any potential success,” said Paul Johnson, associate state director of the Wyoming Small Business Development Center, which maintains eight offices throughout the state. “With low tax rates, it means more income you as a business owner get to keep.”

“Most of our clients are Main Street, mom-and-pop operators,” Johnson told the Wyoming Truth. “Their profit margins are typically so slender, so any savings represents a huge draw for starting a business in Wyoming.”

Wyoming’s composite score in Swyft Filings’ ranking came in at 84.64, led largely by the state’s strength as one of only nine U.S. states that does not impose income taxes.

Illinois, conversely, ranked last among the 50 states when it came to its small business tax environment as measured by effective tax rates, with a score of 29.91.

“Small businesses contribute significantly to job creation, innovation and community development,” Swyft Filings’ Alexandra Conza wrote in a July 5 report. “In fact, they account for around 44% of U.S. economic activity and have historically generated about two-thirds of all new jobs.”

The company, which was formed in July 2015 to assist business creations with required filings and forms, found that Wyoming wasn’t alone among Western states in providing an economic climate conducive for small businesses. South Dakota, Utah and Montana also fared well in the rankings.

Overall, Western states led the nation as a region in imposing the least number of tax burdens on small companies, followed by states in the South and Midwest. Northeastern states, in contrast, had the highest average tax rates placed on small businesses, the report found.

“The state’s low tax rates are one big advantage small business start-ups have,” Brandon Marshall, services director for the Wyoming Business Council, said in an interview with the Wyoming Truth. “To not have that burden right out of the gate is an immense advantage.

“Wyoming’s low tax rates are certainly one big reason why companies consider us when they’re beginning their searches,” Marshall added. “It can definitely put us ahead.”

Advantageous numbers

Swyft Filings’ report echoes another study by the Washington, D.C.-based Tax Foundation, an independent, nonprofit policy organization, in 2022. It also determined that Wyoming has the most advantageous tax rate overall for business, though it notes that some industries – including oil and gas – pay a heavier share of corporate tax.

“Wyoming offers the lowest average effective tax rates for mature businesses and seventh-lowest effective rates for new firms,” the group stated, based on an analysis it conducted together with tax and consulting firm KPMG.

Wyoming maintains a 4% sales tax rate statewide, among the lowest in the U.S., though local jurisdictions are allowed to piggyback on that rate by up to 3% more. The average local added sales tax is 1.83%, Swyft Filings noted.

To determine its rankings, Swyft Filings considered income tax for 50% of its composite scores; sales tax accounted for another 20%; and property tax and unemployment tax rates weighed 15% each.

The company used effective tax rates rather than marginal tax rates because it believes the former “provide a clearer picture of the actual tax burden imposed.” Income taxes were calculated based on $78,000, the annual median revenue generated by small businesses in the U.S.

By comparison, states’ corporate tax rates average 5.23% nationwide, with individual or sole proprietor income tax rates averaging 3.95%. Sales tax rates across the U.S., meanwhile, average 5.07%, which are often supplemented by local taxes averaging 1.33%.

The average unemployment tax rate among the 50 states stands at 4.14%.

“High taxes provide necessary revenue for public services but can also pose challenges for small businesses,” Swyft Filings wrote in its small business report. “They may limit reinvestment opportunities, constrain hiring and threaten business survival.