After Decades of Decline, Wyoming’s Uranium Industry is Bouncing Back

Companies looking to add dozens of new jobs in the near future

- Published In: Other News & Features

- Last Updated: Jul 08, 2023

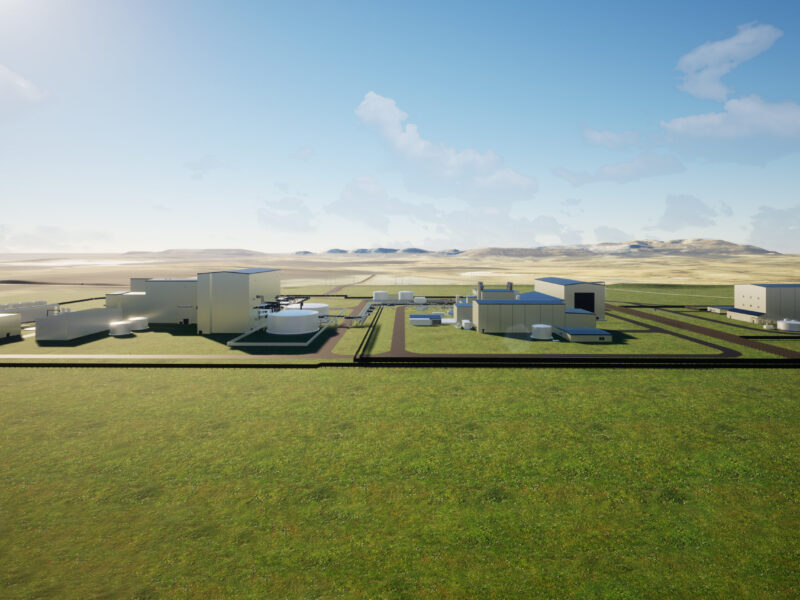

As prices have risen, Wyoming’s uranium industry is on the upswing, with no project bigger than TerraPower’s plans to build an advanced nuclear reactor outside of Kemmerer. (Courtesy image from TerraPower)

By CJ Baker

Special to the Wyoming Truth

After years of decline, Wyoming’s uranium industry is poised for a rebound, with companies planning to add scores of jobs in the near future and potentially hundreds more in the years to come.

“As the interest in nuclear power in the United States grows, and in Wyoming in particular, the future looks bright for this industry,” Peninsula Energy CEO Wayne Heili recently told state lawmakers.

Uranium was once a significant source of employment in the state: In the late 1970s, some 5,300 people worked in the industry, producing 12 million pounds of the radioactive metal each year, Heili said. A decade ago, roughly 500 people were employed in Wyoming, producing 4.3 million pounds of uranium annually. But the U.S. industry continued to wither as competition from countries like Australia, Canada and Russia and declining demand for nuclear power caused prices to crater. By 2021, only about 120 workers remained in the industry in Wyoming, mining negligible amounts.

“We let our uranium mining lag and come to a screeching halt as we found the commodity cheaper on the international market,” Rep. Scott Heiner (R-Green River) said at a June 14 meeting of the Legislature’s Select Federal Natural Resource Management Committee. “And now we find that we don’t have enough uranium source material or enrichment material to be able to supply our own needs — and we kind of were shortsighted in that respect.”

Heiner believes the country will turn back to domestic producers for its nuclear power in the coming years. Such a shift would be a boon to Wyoming, which holds an estimated 450 million pounds of uranium.

TerraPower — a Washington-based company backed by Bill Gates and “like-minded visionaries” — gave the state a boost in 2021 by announcing plans to build an advanced nuclear reactor in Kemmerer. Featuring a pioneering design that’s intended to be smaller and safer, the Natrium reactor will be constructed near a retiring coal-fired power plant.

At a time when Wyoming Gov. Mark Gordon and President Joe Biden’s administration find themselves at odds over energy policy and the role of fossil fuels, the nuclear project has been a rare area of agreement. The “extremely excited” Biden administration has committed nearly $2 billion to TerraPower’s reactor while Gordon and local officials have welcomed the roughly 2,000 construction jobs and 250 permanent positions that the demonstration project is expected to create.

There has been some wariness, with the Wyoming Republican Party bristling at Gates’ involvement. Last year, party leaders passed a resolution that described the TerraPower project as being part of “the economic invasion of Wyoming.”

While the GOP fretted about potential Chinese involvement, the big hurdle for TerraPower has been Russia. The country was expected to be the source of high-assay low-enriched uranium (HALEU) for the Natrium reactor, but importing the material from Russia became untenable following its invasion of Ukraine.

TerraPower now plans to get its HALEU from the U.S., but it will take time, money and, most likely, federal help to build the domestic capacity to produce the material. The change in plans has pushed the expected completion date of the Kemmerer reactor back to roughly 2030.

Bringing high-paying jobs

Other companies are moving more quickly, however, amid uranium prices that have rebounded from less than $20 a pound in late 2016 to around $55 today. After years on hold, Ur-Energy has resumed production at its Lost Creek facility in Sweetwater County while Strata Energy (a subsidiary of Heili’s Peninsula Energy) plans to soon restart its Lance Projects in Crook County. They’re among six permitted and operational mines in the state, Heili said, with several others in the permitting process or waiting to begin construction.

As of December, the industry reported employing 142 people in Wyoming, at an average salary approaching $100,000. Heili estimated that companies are currently seeking to add another 150 workers for mining operations, with salaries ranging from $50,000 to $135,000. Other firms are exploring for uranium, Heili said, which could bring another 150 to 200 jobs.

TerraPower has dozens of job opportunities listed on its website, though only one is based in Wyoming. The job description for the senior manager of nuclear quality assurance calls for 10-plus years of experience at a commercial nuclear power plant at a salary of $172,336 to $247,734.

Although the uranium industry is on the upswing, Heili said it still faces “challenging headwinds,” including rising costs, limited supplies, a tight labor market and federal regulations.

“It’s tough out there,” the Casper resident said, “and it’s nothing like business as usual once looked.”

Wyoming holds the primary regulatory authority over uranium mining, and Duane Spencer of the Bureau of Land Management’s Wyoming office told the committee that the state is “well-poised” to handle any uptick in production.

Heili similarly praised state regulators, saying they’ve cut permitting times and costs. However, he said the BLM’s environmental reviews have been inefficient and cost the industry “millions of dollars and years of delay.” He also charged that pending BLM proposals to boost sage grouse protections and conservation in general could significantly hinder uranium mining.

But Heili struck a positive tone overall.

“While many external factors remain challenging, there’s a great amount of optimism in the industry today,” he said. “The challenges we face are not insurmountable, and there’s a forward movement with the uranium industry now revitalizing and restarting operations around the state.”

Nuclear reactors provided just over 18% of America’s electricity last year, the Energy Information Administration reported, trailing natural gas (39%) and coal (20%), but ahead of wind and solar (14%) and hydropower (6%).

For the first time in over 40 years, a new nuclear reactor is coming online in Georgia, and a second is set for completion early next year. Despite a design intended to allow faster and cheaper construction, The Associated Press noted that the roughly $31 billion Vogtle Plant has run “seven years late and $17 billion over budget.”

TerraPower — which has also faced skepticism about its design — is hoping to avoid similar pitfalls in Kemmerer.