As Wyoming Courts the Crypto Industry, the Feds Remain An Obstacle

The state’s embrace of blockchain technology has been slowed by federal regulators

- Published In: Other News & Features

- Last Updated: Oct 18, 2023

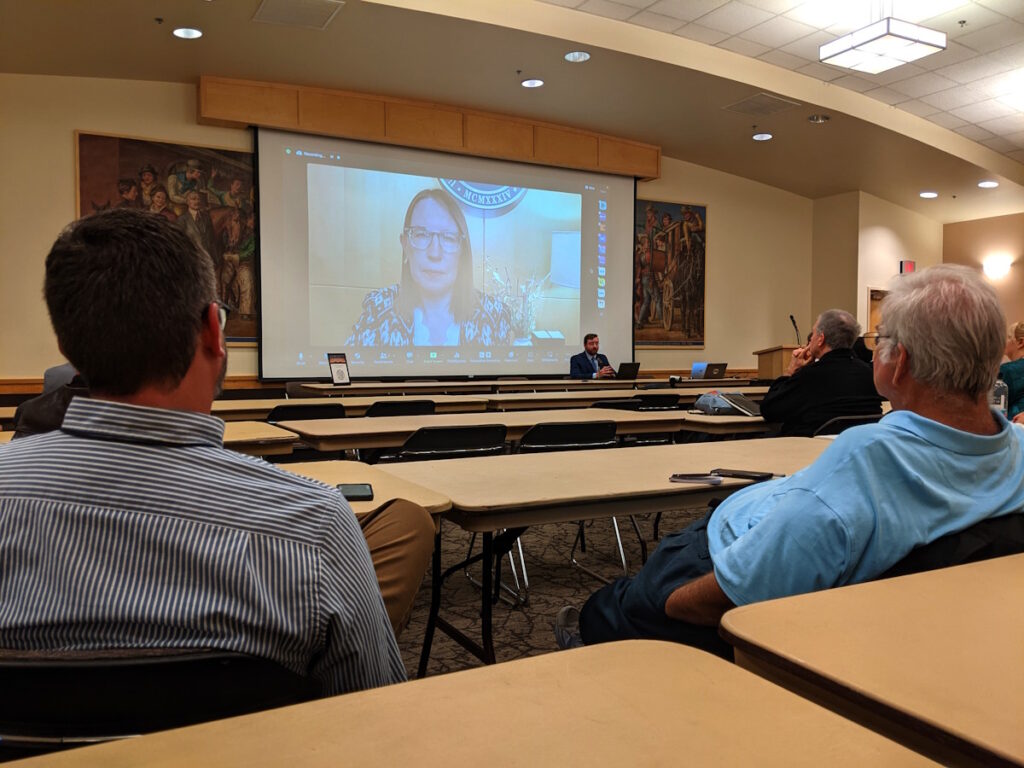

Gov. Mark Gordon addresses the Wyoming Blockchain Stampede attendees on Sept. 14 at the University of Wyoming. Gordon expressed frustration with federal regulators’ hesitance to accept Wyoming’s special purpose depository institutions. (Wyoming Truth photo by CJ Baker)

By CJ Baker

Special to the Wyoming Truth

LARAMIE, Wyo. — As Wyoming continues its push to become the nation’s hub for digital assets and blockchain technology, the federal government continues to stand in the way.

The Biden administration has orchestrated an “all-of-government approach to killing crypto,” charged Caitlin Long, the founder and CEO of Custodia, a new crypto-friendly type of state bank. When the Fed refused to let the Cheyenne-based special purpose depository institution join the Federal Reserve System in January — and blasted Custodia’s plans — Long said it was a part of a “White House crackdown.”

“And I must say, the State of Wyoming got so screwed,” she told attendees at the Wyoming Blockchain Stampede last month. “I’m sorry to use that word, but that is exactly what happened to the State of Wyoming, and so the State of Wyoming has every reason to be angry and push back.”

Creating special purpose depository institutions (SPDIs), which can theoretically bridge the gap between the traditional financial system and digital assets like bitcoin, is just one way Wyoming has sought to court the industry. Since 2016, lawmakers have passed numerous bills related to digital assets in a bid to drive economic development and offer more opportunities for youth to stay in the state.

Legislators are hoping to emulate South Dakota, which attracted the credit card industry by removing caps on interest rates. Even though other states followed suit, roughly half of the country’s credit card providers remain in the Mount Rushmore State, illustrating the “tremendous advantage” of being first, said Sen. Chris Rothfuss (D-Laramie).

Rothfuss said he suspects part of the federal pushback against SPDIs stems from a desire to protect the status quo and those profiting from the current system.

“It’s not that they want to stop it — it’s that they want to make sure that their friends get to catch up,” he told the Wyoming Truth, adding, “They don’t want Wyoming to all of a sudden be a financial technology center instead of, you know, Wall Street. And I think that is in play.”

Other states, such as Texas, Florida and Colorado, have also sought to become crypto hubs, and the idea that Wyoming might lose its edge “is a concern that we talk a lot about,” Rothfuss acknowledged.

Wyoming has already attracted some prominent players in the crypto industry, but Gov. Mark Gordon warned that the holdups from federal regulators could jeopardize the state’s “first-mover status.”

“Wyoming is being held back from advancing financial technology,” Gordon said in a keynote address at the stampede, calling the situation “really frustrating.”

Crypto critics

The promise of blockchain technology — which involves securely linking records together on a decentralized, digital ledger — is faster, more efficient and more trustworthy transactions. Many of the use cases revolve around payments or finance, but advocates see potential that ranges from tracking cattle to trading carbon credits to managing royalty payments; the state has discussed using the technology to help job seekers keep verifiable and readily accessible versions of their college transcripts, certificates and other credentials.

Of course, blockchains are most prominently used to trade and speculate on volatile cryptocurrencies, and that’s attracted a slew of shady characters. The crypto industry suffered a series of multi-billion dollar collapses in 2022, and authorities allege fraud was at the center of many of them. For example, former CEO Sam Bankman-Fried and other leaders of the exchange FTX are alleged to have taken customers’ funds for their own purposes.

While acknowledging there are good actors, SEC Chair and crypto critic Gary Gensler told the U.S. Senate Appropriations Committee in July that “this is a field that’s been rife with fraud and scam and hucksters.”

The skepticism isn’t limited to federal authorities, either. In a recent court filing, the North American Securities Administrators Association — whose members include securities regulators from all 50 states — expressed a dim view of digital assets.

“While they receive outsized attention from the media and regulators because they are aggressively marketed and fertile grounds for fraud, that attention belies the very limited size and significance of this ‘industry’ in the context of the broader U.S. economy,” the association wrote in part.

Flushing out bad actors

At last month’s Blockchain Stampede, speakers openly acknowledged that not everyone in crypto is there for the right reasons.

“I’m an enormous proponent of this space, but I’m the first to admit there’s a ton of bad actors,” said attorney Matt Kaufman, who serves as a liaison to the state’s blockchain committee. However, he thinks Wyoming’s regulatory framework has helped weed out some of them; Rothfuss and U.S. Sen. Cynthia Lummis (R-Wyo.) have both argued that Wyoming’s rules would have prevented the deceptive behavior behind FTX’s collapse.

“A lot of that crap in the industry needed to get flushed, and a little bit more still does,” Long said. However, she said the feds’ broad-based crackdown has ensnared companies like hers that want to comply with the law.

In the absence of clear rules from Congress, the SEC has engaged in what critics see as “regulation by enforcement,” in which the rules only become apparent when the regulator brings an enforcement action against a company.

“Even if you’re trying to do the right thing, it’s quite difficult to weave your way through and figure out what that might be,” said SEC Commissioner Hester Peirce, who’s been an outspoken critic of the agency’s.

Speaking via video at the stampede, Peirce indicated the regulatory uncertainty is having an impact, mentioning one crypto project that recently chose to build in France instead of the U.S.

“This is not our shining moment,” said Peirce. “But I’m also hopeful that we can turn that around.”

Staying ahead of the pack

Whether Congress can find a consensus on crypto regulations remains an open question — as does the potential impact on Wyoming. Former state lawmaker Tyler Lindholm told the Wyoming Truth that clear and comprehensive rules from Congress “could actually hurt us,” because it could put every state on a level playing field.

Still, Lindholm argued that Wyoming remains “lightyears beyond anybody else” and has the most knowledgeable Legislature in the world “by far” when it comes to digital assets.

Rothfuss added that, unlike some other states, Wyoming’s digital asset legislation has generally enjoyed broad support — from the Wyoming Freedom Caucus to Democrats.

“I still think we’re far enough out ahead that, as long as we have some conclusion in the not-too-distant future, we’ll be fine,” he said.

The state is continuing to try to overcome the Feds’ resistance to SPDIs in conversations and in support of Custodia’s ongoing legal battle. In the meantime, Custodia has opened for business. While it has yet to get a Fed master account, the bank offers dollar services, money market funds and, possibly soon, bitcoin custody.

The federal effort to kill crypto didn’t succeed, Long said, “and now cracks in the door are starting to open.”

“It’s a marathon, not a race,” she said, “and we’re actually making good progress.”