High Anxiety: Soaring Costs Take Toll on Mental Health

Wyomingites stressed out over record-high housing and food costs

- Published In: Other News & Features

- Last Updated: Mar 07, 2023

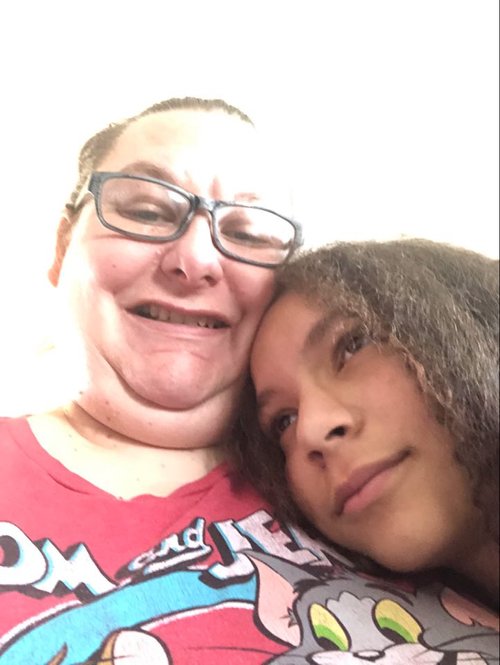

Shauna Rae McLaurin Smith, 51, has skipped house payments in order to procure food for her 10 horses. (Courtesy photo from Shauna Rae McLaurin Smith)

By Jennifer Kocher

Special to the Wyoming Truth

GILLETTE, Wyo. – Talayna Duran had been enjoying life on her own. Last year, the Gillette native moved into her first rental home after landing a job as an electrician apprentice at a coal mine. But since enrolling in college part time and changing jobs, she no longer can make ends meet.

Next month, Duran, 20, will move back in with her parents. The reason? Soaring inflation and record-high food prices.

“It’s been really hard to survive,” she said. “It definitely has me a little anxious as to what the future holds.”

Duran is not alone. A poll from the American Psychiatric Association revealed that nine out of 10 people, or 87% of the 2,210 respondents, feel anxious about inflation, which stands at its highest level in 40 years. And 50% of Americans say they are worse off now than they were in 2022—the highest rate since 2009—according to a January 2023 Gallup survey.

This financial anxiety is prompting changes in spending habits across socioeconomic groups. From C-suite executives who swore off $5 per brick cream cheese on principle to single mothers who gave up eggs at $6 per dozen out of necessity, everyone is feeling the pinch.

And there’s no good news on the horizon. Retirement funds and nest eggs continue to take a beating; credit card balances are skyrocketing; and the Consumer Price Index is still on the rise. Among the latest economic statistics:

- A February report from the investment firm Fidelity found the average IRA retirement account plummeted over $30,000 from last year, with the average 401(k) marking a loss of nearly $27,000.

- Total credit card balances reached a whopping $930 billion at the end of 2022 compared to $785 billion in 2021, according to the TransUnion Q4 2022 Quarterly Credit Industry Insights Report.

- The CPI for all items rose 6.4% in January, according to the U.S. Labor Department. The highest increases to overall monthly expenses were housing (.7%) and food (.5%); energy costs spiked 2% for a year-over-year rise of 8.7%.

High anxiety

Tyler Broderick, a mental health counselor and senior director of clinical services for the Volunteers of America Northern Rockies in Sheridan (formerly Northern Wyoming Mental Health Center), said financial strain can cause emotional problems and relationship strife. In the past year, his agency has seen an uptick in patients presenting with those issues.

“If a person is unable to meet their basic needs financially, it compounds into anxiety and depression,” Broderick said. “It’s a pretty significant thing not to have money to pay rent or eat, especially in winter in Wyoming.”

Financial stress is challenging to navigate, because it sits at the core of a person’s fundamental needs. Often, this leads to “substance abuse issues, which is probably the biggest thing in our area,” according to Broderick.

“People tend to cope with the stress by using drugs and alcohol,” he said. “Usually, that financial burden leads to a lot more conflict in the home. It’s going to have some impact on the children in the home. As financial stress increases, so does anxiety [and] feeling hopeless about your situation and less capable of taking action.”

Corteney Jones, 40, knows this firsthand. In January, Jones and her daughter Carlie, 14, temporarily moved in with Jones’ grandmother in Gillette because she can no longer afford her monthly rent. Jones, who suffered a debilitating injury in car accident, struggles to survive on a monthly $900 disability check.

“I would sink in the world right now if my grandma had not stepped in to help me,” she said.

Along with buying whatever food is on sale, Jones also spreads out her medical appointments; she pays for an eye exam one month and purchases glasses the next as her income allows.

“It’s causing my anxiety to be high,” Jones said. “I’m trying not to let it get to me, but it does.”

Meanwhile, economic uncertainty is making Shauna Rae McLaurin Smith lose sleep. Both she and her husband Matt work full-time jobs in addition to running Heart Smith Ranch, a part-time horse breeding operation in Campbell County.

Elevated fuel, food and veterinary costs prompted them to sell stock, including a favorite stud horse, to keep their operation afloat. “I have panic attacks almost daily,” said Smith, 51. “Just last night, I cried myself to sleep over the fact that I have to part with a horse that I love who was like a family member.”

On multiple occasions, Smith has skipped meals and house payments to buy a bale of hay for their 10 horses, down from 33.

“All in all, inflation on the livestock industry is extremely crippling,” she said. “I honestly can tell you I don’t know if we can do it, but horses have always been in my blood and always will be…I was raised to believe where there is a will there is a way.”

Long-term impacts on ‘lizard brains’

Prolonged financial anxiety historically has had a long-term impact on consumer behavior.

Anne Alexander, an economics professor and interim provost and vice president of academic affairs at the University of Wyoming, noted that the Great Depression and 2008 recession changed American’s spending habits.

Alexander’s parents, who lived through the Depression, still save rubber bands and rarely go out to dinner. They also distrust banks, buying on credit and the government’s ability to step in and save the day.

“Somewhere in the back of their lizard brain is the recollection of starvation,” she said. “There [are] always tiny behavioral changes as a result of inflation.”

Alexander said pandemic spending that prompted consumers to stockpile toilet paper and shelf-stable foods, such as rice, pasta and canned vegetables, remains in play. Many Americans still buy in excess out of fear that prices will continue to escalate, which accounts for the current uptick in consumer spending.

Price instability erodes consumer trust; this, in turn, creates an inherent distrust in economic systems, government and currency, Alexander said.

The emotional cost of ‘unbuying’

Higher-income Wyomingites may not be at risk of losing their housing. But they’re still feeling the squeeze and swearing off little treats to save money. For Sydney D’Agosta, 38, a fitness trainer in Gillette, this means forgoing $50 manicures twice a month.

“I hate looking at my breaking nails,” said D’Agosta, a mother of three teens. “It makes me feel not put together. [But] it was a luxury I simply felt I could no longer afford.”

Broderick, the counselor, said long-term deprivation of these little rewards might lead people to experience feelings of withdrawal that can cause frustration, irritability and anger. “Some people would argue that getting these little treats [is] a form of self-care,” he said.

As many Wyomingites put self-care on hold and focus on getting by, some dream of brighter days ahead—and that may mean going back to the future.

Duran, who will soon return to her childhood bedroom, already has a plan: “I’m hoping to be able to save more money, so I can move [out again.]”