Residents Pack Meeting to Demand Property Tax Relief

Committee to again consider a wide variety of options

- Published In: Politics

- Last Updated: Jun 27, 2023

Like other parts of Wyoming, property values in the City of Sheridan and areas of Sheridan County have shot up in recent years amid an influx of new residents. The corresponding tax increases have frustrated residents. (Courtesy photo from City of Sheridan)

By CJ Baker

Special to the Wyoming Truth

Facing a third straight year of rocketing property tax bills, some Wyoming residents are running out of patience with state lawmakers.

“If you don’t get a grip on this thing now, what will it take? Will it take a civil uprising to get you to realize what’s happening here?” Sheridan resident Neil Ingram asked members of the Legislature’s Joint Revenue Committee on Monday. “These people are being taxed out of their homes. It’s not American — and it’s not right.”

Ingram was among dozens of people who filled up the meeting room at Sheridan College and spilled out into the lobby to demand relief from rising taxes.

“We want correction,” he told the panel. “And we want it now.”

The surge has been especially painful in places like Sheridan County, where an influx of transplants has driven up home prices and, in turn, tax bills. Some homes have doubled in value over the past three years — bringing roughly double bills— and Sheridan County Assessor Paul Fall and his staff have heard from many unhappy taxpayers.

“I’m lucky to have any employees, to be honest with you,” Fall told the committee. “Hopefully you guys can come up with something — put a cap on [annual increases], do whatever it takes to make it right for everybody.”

Lawmakers considered over a dozen bills aimed at providing tax relief in last winter’s General Session, but only three wound up passing.

One expanded the state’s property tax refund program, which allows residents who meet certain income and asset requirements to get up to half of their taxes back; the Wyoming Department of Revenue estimated that roughly 8,000 people applied for a refund this year — well over the 4,400 who applied in 2022.

Another bill calls for an amendment to the Wyoming Constitution that would allow residential properties to be taxed at a lower rate. For the average homeowner, it could provide a couple hundred dollars of annual relief.

Calling for a change

However, the speakers on Monday were at best ambivalent about those reforms. Some argued the separate classification for residential properties will be ineffective, while providing refunds only to those with lower incomes amounts to the government picking and choosing who to help.

Sen. Troy McKeown (R-Gillette) contended that the refund program simply involved shuffling money from one pot to another.

“We run around like banty roosters saying, ‘Oh, look what we did for you.’ [But] We just spent the same amount of money,” McKeown said. “And ultimately the only way we can do property tax relief is [to] cut spending.”

Multiple speakers criticized the state for what they saw as excessive spending, particularly on its K-12 public school system. Half of the state budget “is unconstitutional charity,” one speaker charged. “If you want to spend money on charity, use your checkbook, not mine.”

One of many rounds of applause followed that remark, prompting Committee Co-Chair Rep. Steve Harshman (R-Casper) to note that a committee meeting “is not a talent show or giving campaign speeches.”

Monday’s public comments took a decidedly conservative tone, with the discussion critical of lawmakers at times. Also to applause, Sen. Bob Ide (R-Casper) praised one speaker for her work “to get the right people elected to get rid of bad property tax legislation.”

Many speakers championed a switch to a property tax system based on acquisition value.

Wyoming properties are currently assessed and taxed on their fair market value, but an acquisition-based approach would be tied to what the owner paid for the property, plus a more modest annual adjustment. It would prevent owners from being taxed on the jumps in the real estate market that only benefit property owners if they sell.

The panel received a petition with 1,825 signatures — almost entirely gathered by Rozmaring Czaban of Casper — demanding the state switch to acquisition value.

The Legislature approved a study of a potential change, though Harshman is among the lawmakers with misgivings about the idea. It would be a dramatic change: While the state may spend as much as $4 million on its expanded property tax refund program this year, using acquisition value would see the state education system and local governments forgo some $242 million in fiscal year 2026, the Legislature Service Office estimates.

Harshman wants to form a workgroup to refine the various tax relief options and report back to the full revenue committee in October.

“There’s got to be a solution to this, and we’ll just keep working on it,” he said.

Pain of high prices

Monday’s meeting was primarily intended to be educational and started with a lengthy Department of Revenue presentation that spilled into the afternoon. Some attendees expressed weariness with not only the delay on the agenda (and cramped meeting quarters), but on the issue.

“My expected property tax increase this year is 25%, and I came out pretty darn good compared to my neighbors,” said Jan Loftus of Buffalo, adding, “That’s after two years of the Joint Interim Revenue Committee working on the problem. That’s what I got. So you can see why I might say I lost confidence.”

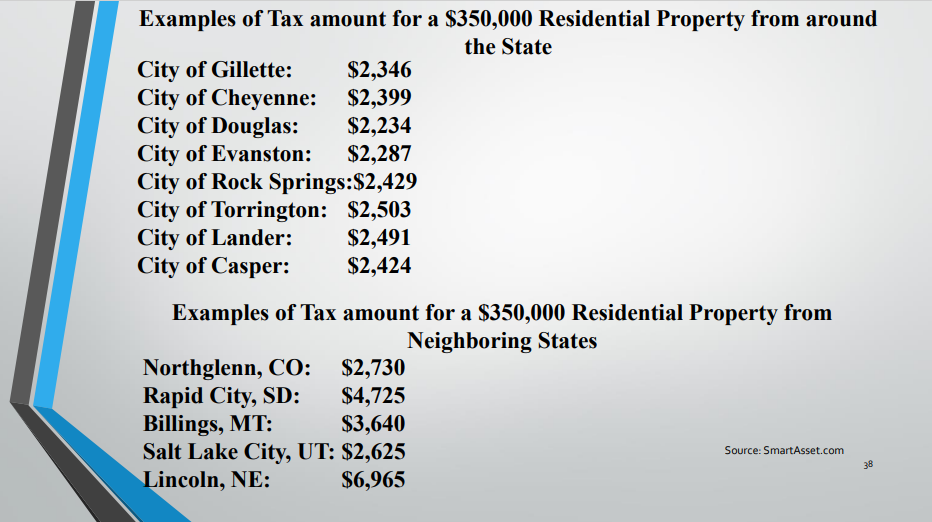

The Department of Revenue noted that Wyoming’s property taxes remain relatively low. For instance, a $350,000 home in Cheyenne would draw a $2,399 tax bill, compared to $2,625 in Salt Lake City, $2,730 in Northglenn, Colorado, $3,640 in Billings, Montana, $4,725 in Rapid City, South Dakota, and $6,965 in Lincoln, Nebraska.

But Park County Assessor Pat Meyer said comparisons offer little solace to taxpayers facing big hikes.

“We don’t dare tell them how great they have it in Wyoming because they don’t want to hear that,” he said.

Meyer began advocating for capping the percentage by which property taxes can rise each year after values in Park County surged 24% in 2021 and another 16% last year. He said much of the increase is due to retirees and others moving in from out-of-state with significant amounts of cash.

The tax increases pose a particular challenge for retirees on a fixed income, and nearly all of the members of the public who spoke Monday were older residents. But they said the issue is having a significant impact on younger generations, too.

Maggie Wisniewski and her husband moved from Oregon to Sheridan in early 2022 and got into something of a bidding war on their home, she said. Amid rising costs across the country, she said they paid $400,000 more than what the previous owners paid four years earlier.

What bothers Wisniewski, she said, is the impact the increases are having on her neighbors: One young family in her neighborhood is moving to Idaho Falls because Sheridan has become too expensive.

“If you want to tax us to where we all have to move, you know, that’s your prerogative,” Wisniewski told the committee. “But I’ll tell you come election time, people are going to start paying attention. People are paying attention now.”