THE RISING COST OF EVERYTHING: Funding College and Planning for Retirement

One Cheyenne family faces college expenses and retirement planning during inflation

- Published In: Other News & Features

- Last Updated: Sep 07, 2022

By Elizabeth Sampson

Special to the Wyoming Truth

CHEYENNE, Wyo.—Inflation can be the unwelcome guest at many of life’s biggest moments. It’s the bewildering cost of living accompanying a young person heading to college and the gut-churning hit to retirement funds creeping up on people inching closer to exiting the workforce.

For some families, inflation is joining them at both ends of the spectrum—college and retirement.

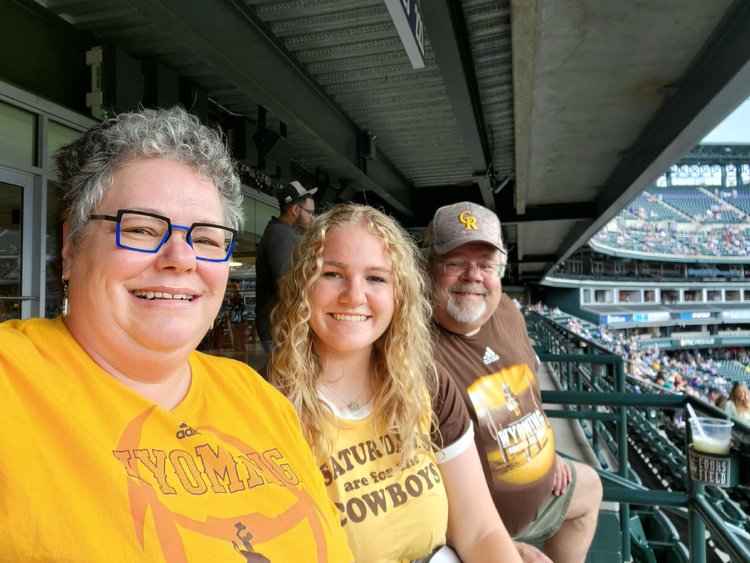

The Larson family of Cheyenne is one of them. Jennifer and her husband, Mike, are helping their daughter financially as she enters her final semester at the University of Wyoming; they are also looking to the future for their own retirement.

Larson, 55, of Cheyenne, and her husband started saving money years ago to help Anna, now a 22-year-old business and finance math major, pay for college. Larson told the Wyoming Truth that she feels lucky that Anna made her way through most of her college experience before inflation spiked and the economy stalled.

However, the Larsons aren’t immune to high gas prices and the rising cost of visiting Anna in Laramie.

“I would say we’ve noticed the price of gas, but it hasn’t thwarted our trips to see her or for her to see us,” said Larson. “The distance is fairly short. It’s not like we’re traveling 500 miles every time we see her.”

It’s no accident that gas is the main area where the Larsons are feeling the financial pinch. Jennifer, a satellite operator for Dish Network, and Mike, the transportation director for Laramie County School District 1, made it a point to be ready to assist with their daughter’s college expenses. They promised to cover room and board wherever Anna chose to study, but she would be responsible for tuition.

Knowing she had skin in the game with her education, Anna worked part time in high school and followed her parents’ advice to put part of every paycheck into savings.

“It’s not just get a paycheck, spend a paycheck,” Larson said. “Early on, one of the things we told her was, when you get a paycheck, you should put at least half of it in savings. The other half you can do with what you want.”

Anna also worked hard in high school and earned the Hathaway scholarship that covered half of her in-state tuition at UW. The current cost of tuition is $2,400 per semester or $4,800 per year, according to the UW website.

Anna held several jobs while in college, including being the first female student manager for the UW football team and working as a K-12 substitute teacher for the Laramie County School District. She continued to put half her income into savings, setting herself up for success whether she decides to enter the workforce or attend graduate school—despite the current economic uncertainty—when she graduates in December.

“I’m really grateful she’ll be coming out of her undergraduate program without any student debt,” Larson said. “I work with a bunch of people that are in their 40s and they’re still paying off debt.”

As for the Larsons, rising inflation has them taking a hard look at their next long-term financial goal: retirement. And it isn’t looking reassuring because their retirement funds took a hit this year as the stock market plunged.

“If inflation stays high, we may have to work longer than we originally thought, or consider lowering our retirement budget,” Larson said.

But since history shows that the market eventually recovers, Larson said she is “hopeful this is just part of that process.”