Wyoming Student Loan Borrowers Look Forward to Some Debt Relief

Biden’s student loan forgiveness plan expected to have a significant impact on borrowers in the Cowboy State

- Published In: Other News & Features

- Last Updated: Oct 06, 2022

By Shen Wu Tan

Special to the Wyoming Truth

For Emily Tutt, any amount of student loan forgiveness is a relief.

Tutt, 28, is completing her medical residency at Wyoming Family Practice in Casper and owes about $180,000 in student loan debt for her medical education at the University of North Texas in Fort Worth.

“I feel like it’s a good start for a variety of situations where that $10,000 could make a big difference for a lot of families depending on what debt that they have,” said Tutt, who graduated from LeTourneau University debt-free, but now earns around $55,000 to $59,000 a year. “There’s another part of me that’s like, ‘Oh gosh, it feels like a drop in the bucket’…It still feels like I am a long way off from paying anything off.”

President Joe Biden announced in August that federal student loan borrowers who make less than $125,000 a year will be eligible for up to $10,000 in forgiveness and up to $20,000 if they received a Pell Grant. Biden also extended the COVID-19 pandemic pause on federal student loan payments and the interest freeze until the end of the year.

The Biden administration anticipates that over 40 million borrowers are eligible for the student debt relief plan, while roughly 20 million could see their leftover balance forgiven.

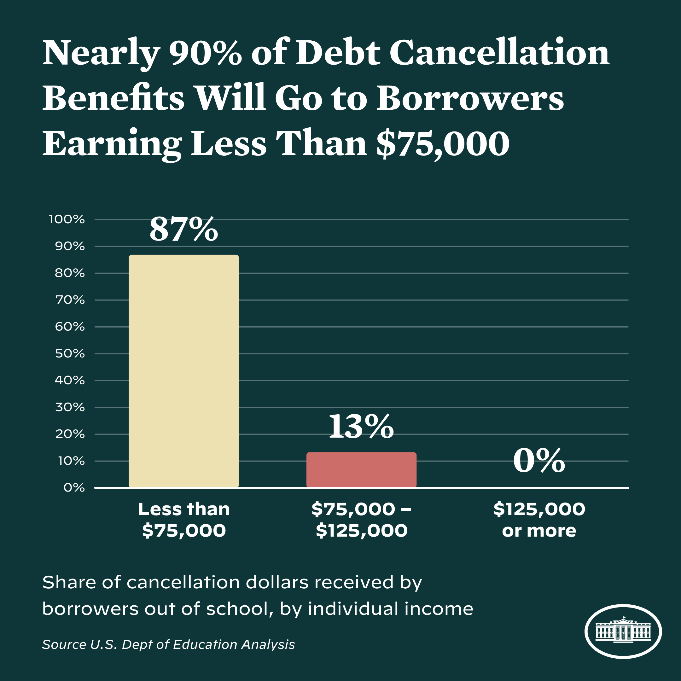

Nearly 90% of relief dollars will go to those earning less than $75,000 per year, and no relief will go to any of the top 5% income earners, according to the U.S. Department of Education.

“The Biden Administration’s student debt relief plan will help borrowers and families recover from the pandemic and prepare to resume student loan payments in January 2023,” the department said in a written statement. “By targeting relief to borrowers with the highest economic need, the Administration’s actions are also likely to help narrow the racial wealth gap.”

However, numerous legal challenges have put the student loan forgiveness plan in limbo for now. The Biden administration earlier announced that borrowers could start applying for relief this month, but said in a Sept. 30 court filing that it will not discharge any student loan debt under the plan before Oct. 17.

Biden and the U.S. Department of Education have agreed to submit their response by Oct. 7 to a motion for preliminary injunction, a court order in a lawsuit that forbids parties from taking a disputed action until the court makes a decision about the case, and to appear for a hearing during the week of Oct. 10 if necessary. The motion was brought forth by Nebraska, Missouri, Arkansas, Iowa, Kansas and South Carolina.

Biden’s student loan forgiveness plan and its effects on Wyoming

Figures from Best Colleges illustrate that Wyoming residents have some of the lowest levels of student debt compared to others across the country.

About 9.5% of the 579,000 Wyoming residents, or around 55,000 people, have federal student loans totaling a balance of $1.7 billion in debt, according to an Oct. 3 report from Best Colleges. The average amount of federal student loan debt a Wyoming resident owes is $31,365, while the average amount of federal and private student loan debt is $23,510.

Another analysis by LendingTree’s Student Loan Hero found that Biden’s loan forgiveness program would have the largest impact on Wyoming student loan borrowers: 37.8% of borrowers—or 19,216—would have their federal student loan debt erased with $10,000 in forgiveness.

Wyoming, followed by Nevada and Utah, has the highest percentage of borrowers who could see their federal student loan balance eliminated by $10,000 in loan forgiveness, the June report from LendingTree shows.

Unlike Tutt, Biden’s plan would cut Taeya Lobato’s student loan debt nearly in half. The Laramie resident and recent University of Wyoming graduate owes about $22,000.

Lobato, 23, who earned a concurrent degree in environmental system sciences and environment and natural resources, currently works in the office at the Associated Students of the University of Wyoming while she decides whether to attend graduate school or pursue employment in her field.

“I see it as a reward for people who are getting a degree and who took that sacrifice of taking out loans that they’re getting at least a little help from the government,” Lobato said about Biden’s student loan forgiveness plan.

Wenlin Liu, chief economist at the Wyoming Economic Analysis Division, said the forgiveness plan will help households divert the extra cash to spend on other higher-priced consumer goods or services.

“This consumption will consequently help local businesses,” Liu said. “However, the timing of the forgiveness, in my opinion, is the big question as the U.S. is facing the highest inflation in 40 years and the lowest unemployment rate in 50 years. The additional demand in consumption from the loan forgiveness will possibly assist the inflation and also will not help to loosen the extremely tight labor market condition.”

Opposition to student loan forgiveness

A number of Wyoming officials oppose Biden’s student loan forgiveness plan, especially given the economic downturn.

In September, Gov. Mark Gordon and 21 other governors sent a letter to Biden expressing their strong disapproval of the policy and noting that college may not be the best route for all Americans.

In the letter, the governors claim the Biden administration is kicking the can down the road and making “today’s problems worse for tomorrow’s students” rather than addressing the rising cost of higher education or working to reduce interest rates for student loans.

Michael Pearlman, spokesperson for Gordon, said the Biden administration’s loan forgiveness plan does not magically make the loans disappear nor will it lower the cost of higher education.

“Instead, this new and poorly thought-through government handout transfers the debt from borrowers to hardworking taxpayers, some of whom already diligently paid off their loans or chose to forgo higher education,” Pearlman said. “This will only exacerbate inflation and continue to increase the costs of everyday goods.”

The governor strongly supports improving financial literacy, Pearlman noted, so that borrowers have a better understanding of what they’re getting into when taking out student loans.

Wyoming has several options for subsidizing higher education, including the Hathaway scholarship that can be used at UW and the state’s seven community colleges. The state also introduced the Tomorrow Scholarship program in 2022 for nontraditional students who are 24 years and older and have unmet financial needs, according to Pearlman.

Rep. Sandy Newsome (R-Cody), who is a member of the House Education Committee, echoed the governor’s sentiments about Biden’s student loan forgiveness plan.

“The borrowers are adults that entered into loan agreements of their own free will,” Newsome told the Wyoming Truth. “It is not fair to require taxpayers to pay for this debt forgiveness program. This is especially unfair to the many citizens that have paid off their student loans…Ultimately it is the responsibility of the student to plan for their education beyond high school.”

The cost of a college education climbed significantly when student loans became easy and commonplace to get, she noted.

“It is not surprising that President Biden is bringing forth spending ideas that are true to the Democrat’s ideology,” Newsome continued. “I believe that these programs are designed to shore up his base before the midterm elections.”

Democratic state legislators on the House and Senate Education Committees did not respond to multiple requests for comment or were unavailable to comment.

The inevitability of student loans

Tutt had no choice but to take out loans to attend medical school and achieve her goal of becoming a physician.

“There’s a lot less choice nowadays for getting certain degrees or levels of income and pursuing your American dream and happiness,” she said. “I think gone are the days where people could work part-time and pay for school that way.”

Still, Tutt understands public opposition to student loan forgiveness to a degree.

“I can see their point of how it’s feeling like we are being forced to pay for each other, but that’s kind of what it means to be living in a society…money moving back and forth between us,” she said. “None of us wants to feel like we’re getting stolen from or we’re paying for things that we shouldn’t. But you know if it’s something that’s going to help our society function better…”

While Lobato is grateful for the student loan forgiveness plan, she, too, understands the pushback.

“Being where I am at right now, I am completely in favor of this,” she said. “But if I was standing on the other side and was like 20 years older and had paid all these [loans] all off…I think I could potentially see the downfall to it.”